reverse sales tax calculator florida

Input the Tax Rate. Whether initiated during a Florida DOR audit or as a completely separate engagement a Florida.

Reverse Sales Tax Calculator 100 Free Calculators Io

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts.

. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. Search only database of. The formula looks like this.

Also please be advised the rate is different in Miami-Dade County. Reverse Sales Tax Calculator Remove Tax. Reverse Sales Tax Calculator.

Collected from the entire web and summarized to include only the most important parts of it. Please check the value of Sales Tax in other sources to ensure that it is the correct value. Formula s to Calculate Reverse Sales Tax.

To find the original price of an item you need this formula. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and. 0621 What is Taxable.

Amount without sales tax GST rate GST amount. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Can be used as content for research and analysis.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. This script calculates the Before Tax Price and the Tax Value being charged. Definition of Reverse Sales Tax Have you ever questioned how much you paid for anything before sales tax was applied or if the sales tax on your receipt was accurate.

Finding how much sales tax you paid on an article is quite easy but knowing the actual cost requires a reverse calculation. Here is how the total is calculated before sales tax. Sales and Gross Receipts Taxes in Florida amounts to 352 billion.

Sales Tax Rate - The total rate of sales tax charged on a purchase. Input the Tax Rate. Before Tax Price - The price of the purchase before sales tax is added.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Always use a minimum sale price of 1000 when determining the fees to record any Deed. Numbers represent only state taxes not.

PRETAX PRICE POSTTAX PRICE 1 TAX RATE. Documentary Stamp Taxes Intangible Tax Calculator. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Input the Final Price Including Tax price plus tax added on. Florida Department of Revenue Sales and Use Tax on Alcoholic Beverages Page 1 R. Enter your before tax purchase price followed by the sales tax rate in your area.

Sales Tax Glossary of Terms. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Amount without sales tax QST rate QST amount.

Calculate Reverse Sales Tax. All you have to input is the amount of sales tax you paid and the final price on your. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

We can not guarantee its accuracy. This sales tax calculator is simple. This script calculates the Before Tax Price and the Tax Value being charged.

Our Reverse Sales Tax Calculator accepts two inputs. Enter the sales tax percentage. Advanced searches left.

A reverse tax audit done by a knowledgeable Florida tax professional is performed to determine if there have been overpayments of Florida taxes. Reverse Sales Tax Calculator Remove Tax. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

You can calculate the Sales Tax amount you paid employing any reverse Sales Tax Calculator sometimes called the Sales Tax deduction calculator or using a simple formula. It is 8156 of the total taxes 431 billion raised in Florida. The reverse sales tax calculator is the easiest and very handy calculator for computing the actual price if you input the sales tax rate and the sale price you paid for a good or service.

Why A Reverse Sales Tax Calculator is Useful. Please check the value of Sales Tax in other sources to ensure that it is the correct value. Alcoholic beverages including mixed drinks beer ale and wine are subject to sales tax plus any applicable discretionary sales surtax surtax imposed by the county where the beverage is sold.

The second script is the reverse of the first. There are times when you may want to find out the original price of the items youve purchased before tax. For additional Fees collected please contact the Clerk of Court for the Florida county in which the property is located.

Reverse Sales Tax Formula. Instead of using the reverse sales tax calculator you can compute this manually. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Floridas general state sales tax rate is 6 with the following exceptions. These are the types of refunds that a Florida Department of Revenue agent may never even mention to you. Selling Price Final Price 1 Sales Tax.

OP with sales tax OP tax rate in decimal form 1. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. We can not guarantee its accuracy.

Home Blog Pro Plans B2B solution Login. Next a sales tax is calculated as well as a total purchase price including sales tax. Following is the reverse sales tax formula on how to calculate reverse tax.

Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1037 on top. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Input the Final Price Including Tax price plus tax added on. That entry would be 0775 for the percentage. Reverse Sales Tax Calculator Calculating Sales Tax.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Florida Business Owner Pleads Guilty To Tax Evasion Faces Federal Prison

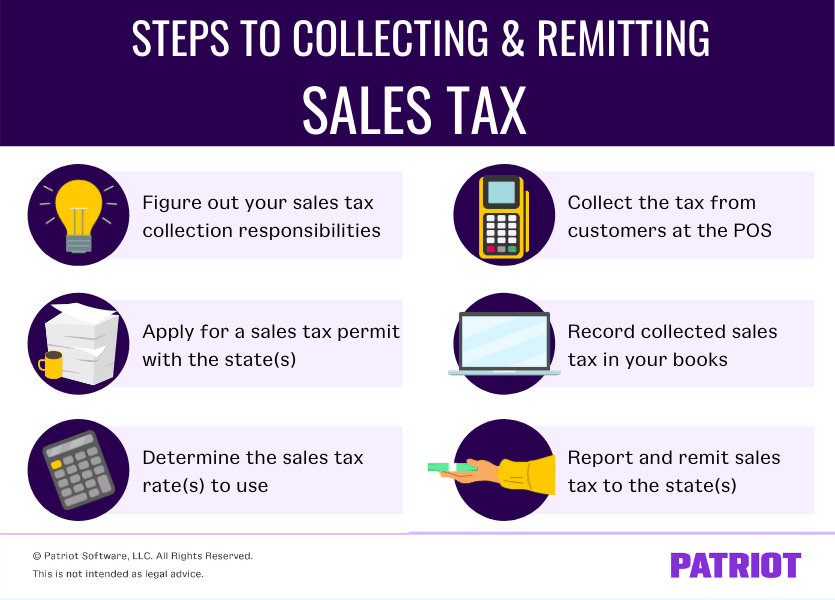

How To Pay Sales Tax For Small Business 6 Step Guide Chart

State Sales Tax For Florida Added To Itun Apple Community

Sales Tax Guide For Online Courses

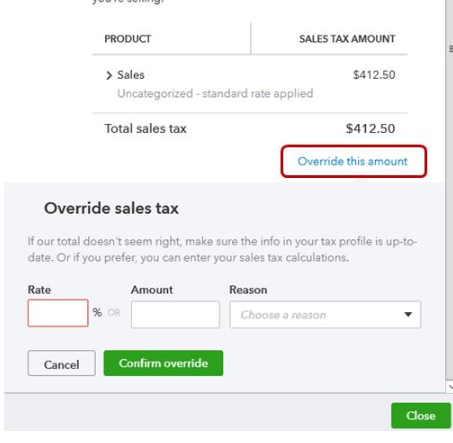

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Real Estate Property Tax Constitutional Tax Collector

How To Calculate Florida Sales Tax On A Car Squeeze

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

إمبراطوري كلير منطق Pa Sales Tax Calculator Wrightwayaircleaningil Com

Gst Composition Scheme May Come Under Reverse Charge Mechanism

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator De Calculator Accounting Portal

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Florida Sales Tax Calculator Reverse Sales Dremployee

Cryptocurrency Taxes What To Know For 2021 Money

Florida Car Sales Tax Everything You Need To Know

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet